The Global Mountain of Debt By Michael Zuber

John Exter was a remarkable man in US economics and finance. His colourful career included positions as Vice President of the Federal Reserve Bank in New York, as Vice President at First National City Bank, and as a member of the Council of Foreign Relations.

But what a black sheep he was during his lifetime! Why? Because he was the only gold bug among his very influential Keynesian colleagues.

Exter was an outspoken enemy of unbacked money (“fiat currency”) and the debt buildup that invariably results from the unrestrained lending that is only possible under fiat currency regimes.

After the US went off the gold standard in 1971 he predicted the eventual deflationary collapse of the ever-inflating debt mountain, unleashing the “worst economic catastrophe in all of history.”

This collapse would be triggered, he said, when the ratio between debt with little real collateral and the few real assets supporting all that debt would become unbearable. The weakest, most levered and least liquid debtors would start to default. That would start a mad rush to preserve wealth in safer types of assets.

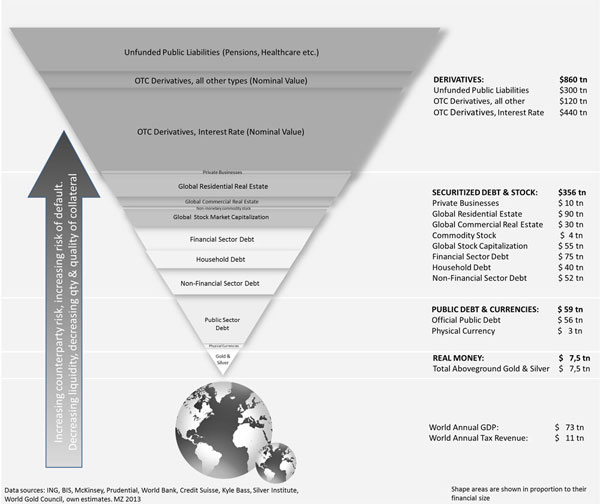

To illustrate his point, he developed the “Exter’s Pyramid”. It depicts an inverted pyramid. At the bottom sits physical gold, the only asset that has no counterparty risk, the only asset that is wealth itself and not a claim on wealth, and thus presumably the safest asset on earth in times of great financial uncertainty.

Rising above it are lesser assets carrying greater risk because of their liabilities.

At the top, one will find the most arcane types of assets, with little or no backing, little liquidity, and little else to show but the creditor’s prayer and hope that the debtor will be both able as well as willing to pay.

Exter predicted that in a looming debt default crisis the creditors would rush to sell the weakest assets at the top of the inverted pyramid and try to move their wealth into the lower, safer and better collateralized layers.

In times of extreme financial stress, only gold as “real money” would be left as a safe haven — in high demand and thus highly priced.

Exter, who died in 2006, would undoubtedly be shocked if he saw today’s ratio of debt to real assets. The global debt-to-GDP-Ratio now sits at a ratio of 3:1, which is unprecedented in modern history. And that’s only the officially reported debt — which does not include a multiple of that amount in largely unbacked, unfunded public liabilities such as public pension and healthcare commitments.

However, until now Exter’s prediction of the worst deflationary global debt collapse in history has been just plain wrong.

What he never envisaged was the global and determined collusion of all First World central banks and their governments since 2008 to do the completely unthinkable: to bail out every failing bank and government by moving the defaulting paper asset on to the balance sheet of either the government or the central bank.

Everyone knows much of the stuff is “toxic” — has no market and little real value. Yet central banks and governments carry it at face value on their balance sheets.

Will that game of “we’re all still solvent if we don’t look too hard” be enough to support indefinitely the largest debt mountain in human economic history? The lessons of financial history lead me seriously to doubt it.

John Exter will eventually prove to be right in viewing physical gold as the Last Man Standing when – not if – claims on all other assets suddenly become questionable.

Although you might not think so, given the weakening investment interest in gold over the past two years, that outbreak of panic could be less than a decade away.

CopyRight – OnTarget 2013 by Martin Spring