The past 60 years have been great for Germany.

Rebuilding a powerful modern economy at the heart of Europe. Establishing an empire of 500 million people based on willing consensus among its territories. Leaving to France predominance in the policymaking of the empire, thus converting a traditional enemy into a close ally.

In defence, happily allowing the Americans to do the heavy lifting. Reuniting the country after the Soviet Union collapsed through the failures of its ideological absurdity. Building an imperial currency on the foundation of its own.

And at home, building a welfare state beyond the Bismarckian dream, whose citizens have one of the shortest working weeks in Europe, excellent medical care and good pensions. German society, says eminent commentator Erwin Grandinger, “has the aura of a luxury retirement home.”

Have the good times now come to an end?

For the first time Germany is being forced to shoulder the burden of empire as its currency is threatened by the accumulating debt of the profligate “Club Med” provinces, losing a fifth of its value in dollar terms in less than eight months.

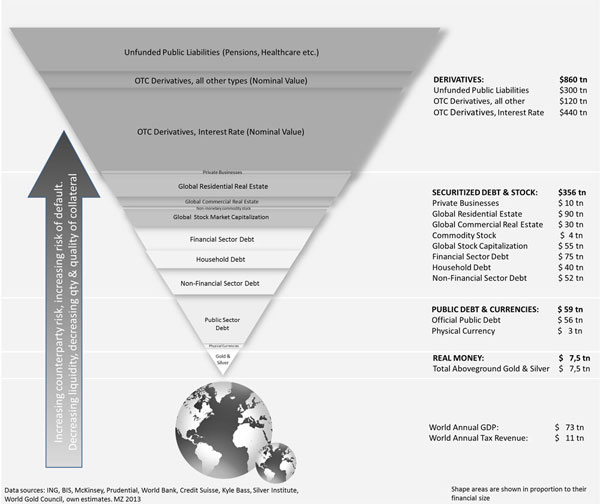

Its banking system, stuffed with toxic waste masquerading as sound investments, much of it bought from the institutional con men of New York and London, is threatened by seizure – only “printing” money on a vast scale by the European Central Bank, it seems, will be able to stave off disaster.

And longer term there are the tightening screws of an ageing and shrinking population, with the unfunded future costs of pension, health and other welfare benefits – the politicians have committed the nation to the liabilities without providing for their financing — pushing public debt, according to one estimate, from 77 per cent of annual national output to an implicit 250 per cent.

The political class allowed the empire to drift into this crisis, often actively promoting high-risk and ultimately disastrous policies. One example was the way the Landesbanken (regional banks fully owned by local governments) were encouraged to gamble on a vast scale, using money borrowed on international markets to buy speculative securities.

The costs to German taxpayers of bailing them out have reached more than €800 billion – so far. And that is without carrying through the radical reconstructions necessary. Instead, the politicians try to divert public attention from their own failures with hysterical attacks on hedge funds and short-sellers, which have played little part in creating the financial mess.

Used to the relatively easy life of the past half-century, the political class has seemed unable to cope with the hard choices of a troubled empire and a society battered by global recession; to provide the strong leadership that is needed.

Partners in the European Union want Germany to boost its domestic demand to provide them with stronger exports and help them grow out of recession.

But German companies have abundant production capacity and don’t need to expand – their capital spending actually fell nearly 20 per cent last year. As for consumers… they don’t have the money to increasing their spending. There has been no increase in wages generally for years, and the famously thrifty Germans aren’t of a mind to go deeper into debt to finance greater personal spending.

In fact, policy now focuses on reducing the fiscal deficit – which must constrain or even contract domestic demand.

Public opinion, frightened by the prospect of future failure in the viability of their welfare state, has driven Germany into adopting a radical plan.

It has changed the constitution so it now requires the federal government to

US Japan China Germany Britain France

Size of economy

GDP $bn @PPP 2008 14,369 4,358 7,927 2,910 2,186 2,122

Living standards

Income per head PPP 2008 47,320 35,258 13,299 36,017 36,259 33,309

Population

Millions 2007 301 128 1,329 82 61 62

Economic growth

Avg. % real growth in GDP/yr 2003-8 2.4 1.7 10.8 1.8 2.3 1.9

Exports

$bn 2008 1,300 781 1,431 1,466 459 595

[PPP = valued at purchasing power parity]

reduce its fiscal deficit to just 0.35 per cent of national output by 2016 (the deficit this year is above 5 per cent), and regional (Länder) governments to achieve balanced budgets by 2020.

The federal government is starting to make the savage cuts in spending and increases in taxes needed to bring down the fiscal deficit to almost nothing. This month Chancellor Angela Merkel announced cuts in federal spending totalling €80 billion over the next four years, with the axe falling on social-welfare and unemployment benefits and defence, with taxes on financial transactions, air travel and nuclear power.

This is the most convincing plan in the world to tackle soaring debt – and it’s pleasing investors. While all the attention in recent weeks has been on the slide in the euro, longdated German government bonds have been strengthening.

Everyone is only too aware of the developing crisis in the eurozone as investors flee the dodgy sovereign debt of Greece and other member-nations now being taken to task for past and current profligacy.

Germany, with Europe’s largest, strongest and soundest economy, is being forced to come to their aid. The German public are furious. They see this as a case of their virtue having to pay for the vice of others. Their own nation’s bad examples are ignored – Germany was one of the first countries to breach the eurozone’s limit on fiscal deficits, getting away with it. And they ignore the great benefits Germany has enjoyed through its dominance of a free-trade, single-currency area – half its exports go to partner nations within the union.

to be continued – Once dubbed ‘The Sick Man of Europe’

CopyRight – OnTarget by Martin Spring