Crises offer the best opportunities for investors, although we need nerves of steel to seize those opportunities.

You might have expected all the bad news from Japan and the Mideast to clobber Asian stock markets. But they have done nothing of the sort.

After a moderate correction, the markets as a whole remain in an uptrend. The bourse you would expect to be hit the hardest, Japan, plunged immediately after the tsunami, but has already recovered half the ground lost and is now well above levels seen last year.China’s share prices hardly winced, and remain in the rising trend that has made it Asia’s best-performing market this year.

Where do we go from here?

There are certainly some strong reasons for being very cautious about Asian stocks for the next few months:

• Wall Street, which usually leads global markets, has lost its upside momentum, in a trend that may develop into something worse than a short-term correction.

It could be signalling the onset of a slowdown in the US economy as it responds to negative factors such as the fading impact of fiscal stimulus, deteriorating conditions in real estate markets, and persistent failure to create the jobs that would fuel rising personal incomes.

The prosperity of Asian economies remains sensitive to the strength of their export markets, particularly the US.

• China continues to keep its banking system under pressure to combat inflation and curb property speculation.

The next 12 months will be a key period in the five-yearly “changing of the guard” of bureaucrats who run the country. Newly-nominated officials will start to have a conservative influence on policymaking, and can be expected to clamp down on inherited excesses once they take power in March next year.

• Japan will take some time to recover from the devastation of the tsunami. In addition to the burden of reconstruction, there will be the need to replace destroyed power-generating capacity. Many businesses have suffered costly disruptions and have to rebuild production lines. There is the continuing problem of a too-strong yen.

• The poorer countries in the region, being particularly sensitive to higher prices of foodstuffs and fuel, which account for a major part of consumers’ expenses, have to combat inflation by keeping interest rates high, or raise them.

Equity markets don’t mind inflation, but they are spooked by the austerity policies that governments apply to fight inflation.

In the emerging economies, policymakers won’t ease up on their squeeze until the prices of foodstuffs and fuel have fallen considerably and are continuing to trend downwards.

Against those negatives, we have to balance the positive factors…

• If the feared “double dip” in the US economy becomes a reality, policymakers will react aggressively to counter it. At the very least, the Fed will forget about its promised cessation of quantitative easing. Notwithstanding all the talk about fiscal restraint, the politicians will once again do what they always do when the pressure is on – find ways to maintain hugely excessive, underfunded public spending.

Although American consumers won’t return to the debt-funded splurge of the past, they won’t stop spending. Personal savings rates have already been restored. They may still be way below the levels needed to address fundamental problems such as the looming burden of pensions and healthcare, but they are probably not going to go up much more, unless (until?) there is another financial crisis that shocks consumers into greater thrift.

Consumer caution and the impact of a weaker dollar will combine to restrain growth in US imports, but Americans will remain addicted to low-cost supplies from abroad. There will continue to be exciting new products such as iPads, largely made in Asian factories. And American corporations will maintain their aggressive focus on underpinning and boosting their earnings through cost-cutting, much of it based on outsourcing overseas.

Asian exporters may not see strong growth in their foreign markets – but those markets aren’t going to collapse. And domestic demand inside Asian nations will continue to expand relatively strongly in line with continuing good rates of economic growth.

• While continuing to combat excesses, Chinese policymakers won’t risk squeezing too hard. The need to continue maintaining high economic growth – averaging at least 7 per cent a year in real terms – will outweigh the need for restraint.

• While continuing to combat excesses, Chinese policymakers won’t risk squeezing too hard. The need to continue maintaining high economic growth – averaging at least 7 per cent a year in real terms – will outweigh the need for restraint.

Inflationary pressures in China are likely to flatten out, and then to start easing, within a few months.

The relative strength in Chinese equities suggests that investors are starting to return to the market in expectation of a renewed upsurge.

• The pressures of short-term factors that have been driving up international prices of many agricultural commodities are likely to ease. In any case, the most important foodstuff in Asia, rice, has been spared. The probability is that food price inflation, the major source of consumer inflation in emerging economies, will soon begin to fade.

The second most important source of worry – the oil price – is more difficult to predict, given the disruptive impact of the Libyan crisis on global supplies. But the probability is that we have already passed the peak in pricing pressures. So far the crisis doesn’t seem to have done much more than use up some of the surplus in global capacity. And any cooling in commodity prices generally will ease the pressure from speculative buying.

The principal alternative to oil, natural gas, remains cheap and in abundant supply.

• Although the tsunami has been a human disaster for the Japanese, the consequent rebuilding will provide a major economic stimulus.

It is important not to confuse a loss of wealth – in real estate, factories and human capital – with the very much smaller loss in Japan’s annual production.

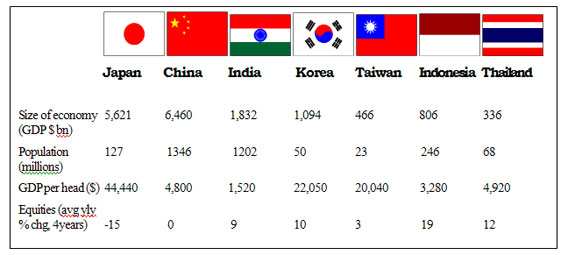

The Japanese economy remains a global giant in its size, sophistication, advanced technologies, and the skills and hard work of its people. Its recovery is likely to surprise on the upside.

more to follow – Chinese shares likely to lead the next upsurge

CopyRight – OnTarget April 2011 by Martin Spring