Over 2014 there has been a steady decline in the yield on German government bonds. As a result bunds have outperformed other developed markets.

This outperformance could have been driven by two factors:

- The rising liquidity premium – the premium investors are willing to pay to hold the sovereign bond (in terms of lower yields) rather than a government-guaranteed agency bond of the same maturity

- Concerns over the European recovery and the risk of deflation

Figure 1 provides an estimate of the liquidity premium for bunds over the period. This is calculated by subtracting the yield on the bund from the agency bond. When there is demand for safe haven assets, the yield on the bund falls and the liquidity premium rises. Two such periods are highlighted in the chart, the first in February when investors became concerned about the impact of the crisis in Ukraine and the second in July when the Malaysian Airlines flight was shot down over eastern Ukraine. However, despite these periods of heightened geopolitical tensions and risk aversion, the overall trend in 2014 has been a decline in the liquidity premium.

This suggests that concern over the European recovery and deflation played a more important role in the outperformance of bunds. Last week Mario Draghi, president of the European Central Bank (ECB), announced that the bank had “intensified preparatory work” on quantitative easing as a potential tool to fight deflation and the economic slowdown. However, markets were not convinced. The 10 year German breakeven rates (the difference between the yields of nominal and inflation-linked bonds) collapsed after Draghi’s speech (figure 2), while the spread between bund and periphery yields widened (figure 3).

Furthermore, Russian sanctions on Europe that impact growth have yet to be reflected in growth data. These are worrying signs that the ECB might still be behind the curve in terms of its policy action. We therefore remain neutral on German bund exposure even though yields are at multi- year lows.

Low volatility for now, but risks are to the upside

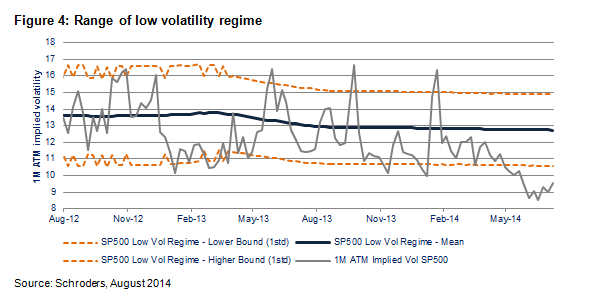

In the second quarter of 2014, market volatility continued to head lower helped by recovering US macroeconomic data and dovish forward guidance from the Federal Reserve (Fed) and the ECB. The implied volatility of 1 month at the money (ATM) S&P 500 options – where the strike price is equal to the current price – reached a new low, unseen since 2006 (figure 4). While we believe we are likely to remain in a low volatility regime, some short-term catalysts may move market volatility higher.

Looking at the open interest (or open commitments) of equity option contracts, market participants seem to be better prepared for a correction across global equity markets than they had been in May. Earlier in the year positioning was mainly concentrated in put options that were either at the money or where prices needed to fall by 10% to bring the option into the money. Since then there has been a shift towards further out of the money contracts. As shown in figure 5, 8% of outstanding contracts require prices to fall by 40% to be in the money, while 10% require falls of 50% or more. Therefore it appears more investors are protecting their portfolios against severe falls in prices.

Over the early summer, volatility has again flared up in reaction to a confluence of geopolitical events. Skew, which measures the premium that buyers of put options pay over buyers of call options, reached high levels in markets such as the S&P 500. A reasonable protection strategy could involve buying put spreads (buying a put option and selling a put option with a lower strike price in order to reduce the cost of protection) in expectation of a continued, but contained, market fall.

While the fundamental picture remains consistent with a low volatility environment, some catalysts could increase risk aversion such as interest rate policy changes, geopolitical events and disappointing growth data. Of these risks, the tensions over Ukraine could impact Europe, which is struggling to move into a sustainable recovery. Additional risks could emerge such as the European Asset Quality Review (AQR) of the banking sector, and the US mid-term elections in the fourth quarter.

Although the stress presented by policy-related uncertainty in the US and Europe appears to be low at present, the recent flattening of the US government bond yield curve shows how sensitive economic growth and long-term inflation expectations could be to such a change of policy. The delivery of growth and the ongoing flow of liquidity from central banks remain critical for the low volatility environment to continue.