The Basics of Sound Personal Financial Planning

Globalization has changed our personal financial circumstances dramatically in a way that was unthinkable for our grandparents. My own situation is not unusual – I am domiciled in one country, live much of the year in another, and holiday in a third, holding citizenships of two of them.

This globalization of our lives opens up business and investment opportunities. But it also increases the complexity of our moneycraft as we move beyond our familiar base to places with different modes of behaviour, tax and legal systems.

Getting appropriate guidance on dealing with these issues is not easy. Much of what passes for information about global personal financial planning is naïve and simplistic, depending too often on what suits fund managers pushing their own financial interests, rather than yours; their natural tendency to promote the assets they know best; what suits professional advisers to say to avoid attracting the hostile attention of the authorities.

There is the additional problem that much decision making has to be influenced by not only where you live and work, but also by what citizenship you hold and the tax regimes to which you are subject.

In trying to chart your way through the complexities, it’s important to keep in mind the basic principles of sound international personal financial planning.

Here are some of them…

Practicality. If you’re going to do things the legal route, as most people prefer, it’s important to structure your affairs for simplicity and convenience.

You cannot get much diversity or balance in a portfolio if you have only, say, $100,000 or the equivalent, to invest outside your own country.

Unless you are particularly keen and have a considerable amount of time to monitor and manage your affairs, you need a simple long-term structure that will work for you without frequent investment switches. In any case, lots of chopping and changing is a bad idea. The expenses mount up and depress your returns.

It usually pays to channel all or most of your business through a single intermediary or financial institution – one you know and trust that provides you with consistently good reporting, processing and advice.

Confine your investments to a very small number of funds or individual securities. They’ll be easier to keep an eye on, and your expenses will be minimized.

One simple way to do this is to use a multi-manager fund that does the selecting and monitoring for you. Just make sure that it delivers reasonable performance for the fees it charges.

A better idea is to manage your assets yourself, as no professional can afford to devote the amount of attention to your investments as you can yourself. And you can develop the skill to take occasional contrarian bets of the kind that financial institutions, with their usually timid, consensus-driven strategies, and other limitations, hardly ever risk.

However, the do-it-yourself approach will only work if you keep things simple.

Investment returns. Intermediaries will tell you that most clients want high returns without risk. Those are contradictory requirements, as rate of return is always related to the level of risk.

You can expect to get higher returns by investing in equities rather than bonds, or in bonds rather than fixed deposits; in small companies rather than big ones; in corporate bonds rather than government-backed securities; in emerging markets rather than developed ones; with small financial groups rather than large entities – but the price will always be a higher level of risk.

However, diversification is a standard technique for reducing risk, and should always be applied in an international portfolio.

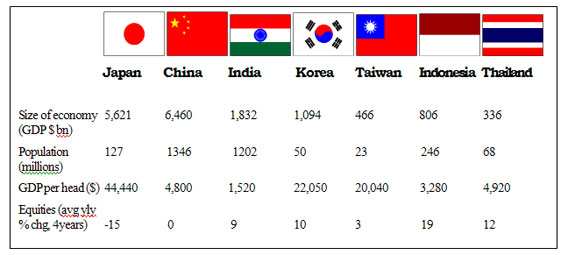

One way to ensure balanced diversification is to set guidelines for the composition of your portfolio, for example aiming to have one third of its assets in North America, a third in Europe (including the UK), and a third in the Asia-Pacific region.

An alternative approach to diversification is to focus on sector choices — resources, technology, healthcare, and so on – instead of geographical location. Or on concepts such as Dividend Aristocrats (companies with consistent records of paying dividends over many years), or Autonomies (well-managed, financially strong multinationals geared to the growth of the global middle classes).

Don’t expect to get anything greater than average returns for the asset classes in which you invest. If you do better, you’ll be lucky. Most people do worse than average because of trend-following, excessive buying and selling, and expenses.

next article: Currencies: do you think in dollars?

CopyRight – OnTarget 2012 by Martin Spring