Although soaring grain and soybean prices have focused attention on global food supplies, they are a temporary phenomenon, a consequence of weather extremes and other natural disasters that come and go.

There are much more important longer-term reasons for taking note of the investment potential in agriculture. Netherlands-based Rabobank, which focuses on agri-business, says the world’s food production will need to rise by 70 per cent over the next 40 years.Shrewd investors are moving in where they see long-term opportunities. State enterprises have been buying up millions of hectares of agricultural land, especially in Sudan, Mozambique, Liberia, Ethiopia and Cambodia, to provide secure imported food supplies. Private investors have gone farming in South America and Eastern Europe.

There are several reasons why demand for food is growing strongly while supply struggles to keep pace with the growth.

Hundreds of millions of people, especially in Asia, are becoming wealthy enough to eat better – less starch, more dairy products and high-quality protein. That puts grain and soybean supplies under pressure – it takes more than eight kilograms of feed to produce one of beef and about four to produce one of pork.

In the case of China and India, fund manager GTI reports, “half a billion new urbanites will be moving from rice to ribs over the next 20 years.”

There is also the new, politically-driven demand to divert land from growing food to providing feedstock for manufacture of alternative fuels. Ethanol production now consumes nearly two-fifths of America’s corn crop.

Diversion of land to urban and industrial development, desertification and water shortages eat away at the amount of arable land available for cultivation.

Although there are large additional areas that could be farmed, mainly in Africa and South America, such development faces formidable problems — local political opposition, the need to build essential infrastructure such as roads and storage/refrigeration centres.

Climate change, whatever its cause, seems to be producing shifting weather patterns, more frequent extreme weather events and rising temperatures that threaten yields and crop failures, particularly in the developing world.

However, these negatives are being countered with technological advances such as development of drought-resistant varieties and the spread of key information (commodity prices, weather forecasts) to farmers. And a stronger policy focus on food production (for example, subsidized fertilizers and seeds have converted Malawi into a food exporter).

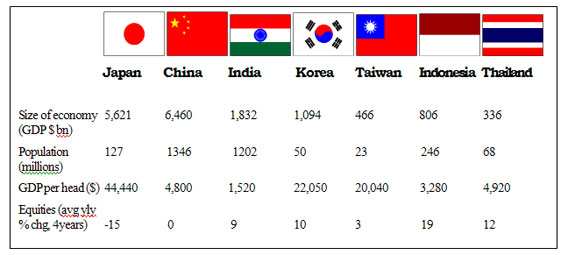

GTI provides this interesting table of investment opportunities:

| Sector | Share | Comment |

| Fertilizers | Potash Corp. | Canadian supplier of 20% of world potash |

| Yara | Largest nitrogen fertilizer supplier (Norway) | |

| Agrium | Specialty fertilizers and agric. products N.Am.) | |

| Mosaic | Phosphate and potash (N.America) | |

| Potash One | Canadian potash exploration | |

| Farm equipment | Deere & Co. | No.1 in farm equipment |

| Agco | Big in tractors, combines; active in China | |

| CNH | High-tech tractors (FIAT-owned) | |

| Agribusiness | Bunge | Integrated American farm-to-consumer business |

| Viterra | Canadian grain handler | |

| Agr. science | Monsanto | World’s biggest seed supplier; 90% of GM seeds |

| Syngenta | Plant technology, crop protection | |

| Food processors | Wilmar | Leading Asian agri-business (oil crops) |

| Archer Daniels Midland | Processor, cereals, palm oil | |

| Land and farming | SLC Agricola | Brazil agri-group: cotton, soybeans, coffee, corn |

| Brazilagro | Another Brazilian agri-group | |

| Forestry | Plum Creek Timber | Largest private landowner in the US |

| Svenska Cellulosa | Largest forest owner in Europe | |

| Rayonier | Forest products | |

| Weyerhaeuser | US lumber giant |

There are several funds that invest directly in agriculture. The largest is the dollar-denominated SICAV Schroder Alternative Solution Agriculture. However, it invests almost entirely in soft commodities.

Other funds invest mainly in equities, so they can benefit from growth in business sectors such as agricultural science and farm machinery. They include the sterling-denominated OEICs Sarasin AgriSar and Baring Global Agriculture, and the dollar-based SICAV Allianz RCM Global Agriculture Trends. Unfortunately none has a long track record.

CopyRight – OnTarget December 2010 by Martin Spring