Scarcity of resources for maintenance, replacement, expansion

There are also lots of goodie-goodie public relations opportunities in being seen as major promoters of social goods such as roads, railways, airports, schools, hospitals, power and water services.

In 2009 CIBC World Markets forecast that over the next 20 years global investment in infrastructure would reach $35 trillion.

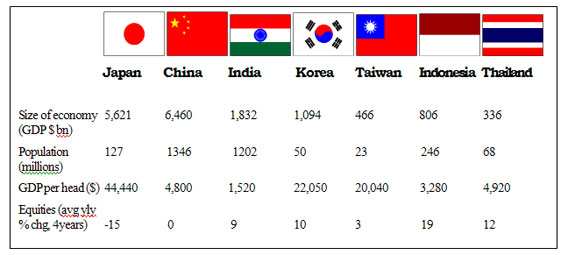

A handful of countries have over-invested in infrastructure – Japan, China and Spain come to mind. But in most nations there are huge backlogs.

Governments skimped on maintenance, replacement and expansion needs so they could divert resources to growing (underfunded) welfare benefits, saving mega-banks and zombie mega-companies from collapse, fashionable trivia of the chattering classes such as renewable energy, and the odd war or two.

One example is the US, where the network of water pipes, more than a century old, is in such disrepair that in 2006 more than 3½ million people fell ill from escherichia coli poisoning and from toxins released from over 40,000 sewage spills, according to that nation’s Environmental Protection Agency.

Both political and economic factors support the prospect of increasing focus on developing infrastructure over the next decade or two.

However, from an investor’s point of view, it is important to bear in mind that infrastructure is a broad church. Many reasons explain why some specialist funds and companies in the sector offer yields as low as 2½ per cent, others as high as 10-plus per cent.

- Greenfield developments – those that are planned, under construction, or built but not yet operating fully – are much higher risk. They may never be completed, or construction costs be much more than expected, or face serious operational phasing-in that delays the start and build-up of income.

Most institutional investors stick to “core” assets – projects that have been completed and are fully operational, so their expected cash flows can be reliably assessed.

As with property developments, older assets are less favoured because of their steadily-rising maintenance and replacement costs.

see previous article – An Opportunity for Long-term Income

CopyRight – OnTarget 2012 by Martin Spring