Both sides of this debate support the need for structural reforms, but Keynesians argue that austerity makes them more difficult to achieve. For instance, if you wish to liberalize the labour market, the initial consequence is likely to be higher unemployment. You need to cushion that through state benefits until the delayed greater efficiency produced by reforms comes through.

This article continues on from the first article – How to Break Out of “Contained Depression” .. this is the 2nd article of 3

There is a political dimension to these opposed economic strategies. Both sides see benefits that they favour politically, as well as ones that would benefit economic growth.

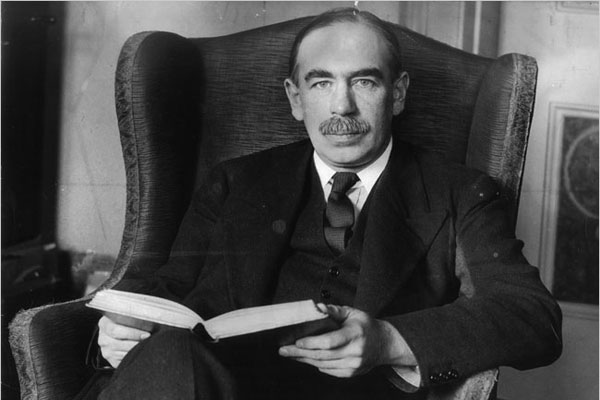

Paul Krugman – well-known Leftist

Krugman, for example, a well-known Leftist, says that through the political process the US economy is “largely rigged against those who work for a living; one designed by people who live off a return on capital, and care nothing other than preserving and expanding it.

“Their victims litter the landscape: a disappearing middle class, high unemployment and underemployment, declining living standards for the 90 per cent, a massive increase in poverty, and the worst income inequality since the Gilded Age.”

The share of national income earned by the top 1 per cent began climbing in the early 1980s and now stands close to the record set in 1928. (Is that an ominous precedent, being just one year before the catastrophic collapse on Wall Street?)

Others, myself included, are not convinced that either of the two policies as currently being implemented – austerity or stimulus – are the answer to sluggish economic growth in the mature economies.

“Both of these policies are so clearly broken that a third way that addresses these is now the most urgent issue facing policymakers and investors,” says Paul Gambles, managing partner of MBMG International (and a reader of On Target).

I asked him what “third way” he suggests. He responded that the key is a radical reduction in the global burden of debt – interestingly he stresses “especially private debt,” rather than the public debt that receives most media attention.

That requires a “re-set” whose pain would have to be shared equally between “society as a whole, and those most able to pay.” That would require:

- Higher progressive taxes, including much heavier taxation of “unproductive higher levels of personal and corporate wealth.”

- Removal of all support for the financial system – “weak banks must be allowed to fail, shareholders and bondholders must suffer most of the pain,” clearing the way for banks to lend.

- Strict re-regulation, especially in the financial services industry.

- As state-owned and operated essential services are run inefficiently, while “private ones are a social disaster,” they should be reformed so they are managed “a better hybrid way… with the private-sector running essential services on a cost-plus basis for governments.”

There is one article to follow: Policies must focus on wealth creation

CopyRight – OnTarget 2014 by Martin Spring