The fundamental problem in the world economy is deflation brought about by over-supply that was not recognized until the credit bubble burst, argues Russell Napier, a highly-regarded strategist at the CLSA investment bank.

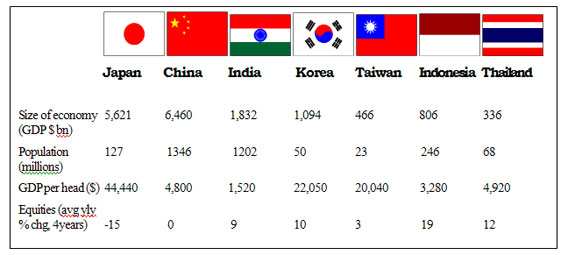

In North Asia a system that targets full capacity and full employment, with little interest in return on invested capital, is designed to over-produce.

“Year after year, Japanese society weathered dire economic conditions rather than abandon their focus on over-production and over-employment,” Napier argues. In China there has been similar over-production, “fed by the milk cow of a command-economy banking system.”

Faced with this avalanche of goods, other economies adapted to consume the cheap products provided at uneconomic rates. Central banks provided cheap credit to finance strong consumption, keeping low both inflation and interest rates. “And rising asset prices produced the illusion of reasonable savings to provide for an ageing population,” Napier says.

Fed chairman Alan Greenspan “spent most of his career fighting off the deflation which the North Asian model threatened.” But by 2008 “monetary policy was no longer sufficient and a mighty fiscal response was thrown against the deflationary dynamic.

“The refusal to accept the deflation imposed by the North Asian model has produced massive government intervention,” and pushed fiscal debt sharply higher.

Napier warns ominously that the scale of the public debt burden now developing is so great that, unless there is much lower demand for credit by the private sector (because of poor economic growth?), Western governments will be left with no option but to intervene in markets to “force private sector capital into action in support of public debt markets.”

Napier argues that “the roll-back of the free market has already begun… Commercial banks’ new capital adequacy ratios already require banks to hold higher levels of government debt. In due course a transaction tax on financial instruments apart from government debt will come to pass.

“The ultimate weapon to force private savings to fund governments will be capital controls.”

Frightening stuff. If you think Napier’s view of the future is likely to be correct, plan your long-term investing accordingly. I won’t try to say how in a few short sentences. It requires a lot of detailed planning and shaping to individual circumstances.

CopyRight – OnTarget by Martin Spring