Jeffrey Gundlach, the American fund manager who correctly forecast the surge in bond prices this year, contrary to the overwhelming majority of the experts who got it wrong, remains fundamentally pessimistic about economic growth in the US. [Read more…]

JPMorgan agress to settlement

JPMorgan agrees $13 billion settlement with U.S. over bad mortgages [Read more…]

Millions Toward Proprietary Investments

PHILADELPHIA, Aug. 27, 2013 – FS Investment Corporation, a business development company focused primarily on investing in the debt securities of private U.S. companies, announced today that it committed over $200 million toward proprietary investments in middle market companies during the month of July. [Read more…]

Investment theory

New research by two American experts has demolished the key belief of efficient market theory, which several generations of students were taught as the foundation of their investment skills, that high reward is the consequence of accepting greater risk.

Their study of 21 developed and 12 emerging markets that lower-risk low-volatility stocks consistently delivered market-beating returns.

Between 1990 and 2011 the least-volatile decile of developed nations’ shares generated total returns averaging 8.7 per cent a year, while the most-volatile produced a negative 8.8 per cent a year. In the US alone, the comparable figures were a positive 12 per cent average and a negative 7 per cent.

One of the researchers, Robert Haugen, of a California-based research house, says the outperformance by low-risk stocks in every country contradicts “the very core of finance,” turning upside-down the theory about risk and return.

CopyRight – OnTarget 2012 by Martin Spring

for more on Martin Spring see – TheBizSense Views – Views & Forecasting

US oil prices settle above $102

New York – US oil price rose on Wednesday and settled for the first time above $100 since September 2008, as unrest in Libya continued and US crude inventories dropped.

On Wednesday, airstrikes took place close to the oil fields in Libya – sparking further fears among investors and traders that the supply disruption of this OPEC member state would continue.

Libya’s National Oil Corporation Chairman Shokri Ghanem estimated that Libya’s oil output has been reduced to 700 000 from 750 000 barrels per day because of the departure of most foreign workers. He said if the unrest continued, oil price could hit $130 dollars a barrel this month.

Anxieties about long-term oil supply were further increased by the instability of other countries in the area of North Africa and Middle East.

Meanwhile, the Energy Information Administration reported that US crude inventories fell 400 000 barrels to 346.4 million barrels in the week ending 25 February, ending its six weeks of straight rise.

Experts expected oil prices to keep rising as supply disrupted at the time of demand picked up.

Light, sweet crude for April delivery gained $2.60, or 2.61 percent to settle at $102.23 dollars a barrel on the New York Mercantile Exchange – having surged about 20 percent since the breakout of Libya’s unrest.

In London, Brent crude also surged and last traded around $117 dollars a barrel. – BuaNews-Xinhua

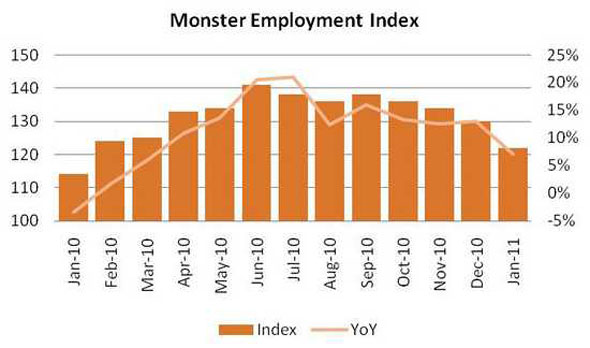

US recruitment shows growth

A major US online recruitment index has shown that online demand for workers experienced a 7 per cent year-on-year rise in January.

The Monster Employment Index, put together by online recruitment site Monster.com, showed that all of the 28 major city markets they monitor across the US showed positive annual growth in January.

Jesse Harriott, one of the senior vice presidents of Monster behind the compilation of the index, said that certain sectors were showing consistent growth and opportunity – with mining and wholesale trade actually showing the greatest demand for labour.

“Private sector hiring, including in IT, business and healthcare occupations has been fuelling growth which is encouraging,” she said. “At the same time cuts in government-related recruitment since December are weighing down on overall growth, but not enough to prevent year-on-year growth for the first month of 2011.”

The index surveyed 20 sectors in total, with 12 showing positive annual growth. Demand for jobs and labour in wholesale trade rose by 14 per cent, which was matched by professional, scientific, and technical services.

The industries in the private sector that showed the slowest annual growth in January were accommodation and food services, which fell on the index by 16 per cent.

Geoff Newman, chief executive of online recruiter Recruitment Genius, commented “The increased demand for workers is excellent for our US operation which is noticing significant growth. Importantly it also represents hope for the UK economy which is going through a bumpy recovery.”