TheBizSense Views

Business Viewpoints and Forecasting

Category: USA

Featured

Jan 29, 2014

Contained Depression

Books

Nov 14, 2013

Keys to Improving Your Investment Profits

Featured

Sep 18, 2013

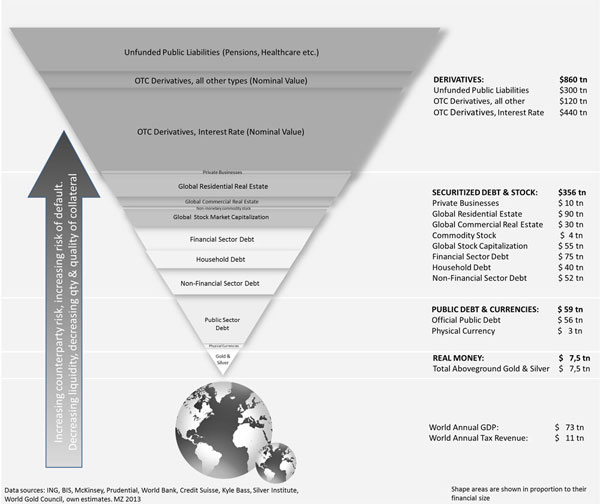

The Global Mountain of Debt

Britain

Aug 02, 2013

Quantitative Easing Madness

Business

Jun 27, 2013

View on US, Emerging Markets

Europe

Apr 04, 2013

Risk of an Attack of Nerves

Business

Mar 16, 2013

Just a matter of time

ASEAN

Feb 19, 2013

Profligate money creation in Europe

ASEAN

Feb 11, 2013